The Biden Student Loan Forgiveness Plan

September 21, 2022

In the mid 1900s , college tuition in the United States was generally affordable for middle-income families, but scholarship aid from colleges, state governments, or federal programs was limited, and provided financial aid usually came in the form of small loans. However, in 1972, a bipartisan majority in Congress enacted the Basic Educational Opportunity Grant Program, aiming to utilize need-based grants to help cover tuition and living expenses for low-income students. Boosted student enrollment consequently increased a demand for federal student aid, leading to an increasingly expensive college tuition, causing student loans to be drawn, and debts to be paid.

According to Forbes Advisor, college students in the US have accumulated “$1.75 trillion in total student loan debt”. This creates an obstacle for students to pursue their education, which has remained a hurdle for years.

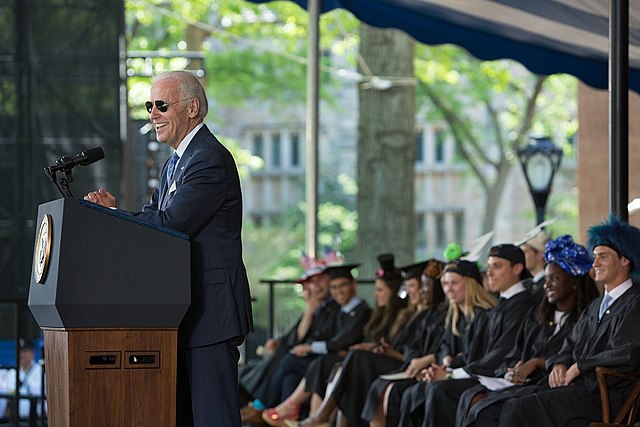

In response to this increasing issue, US President Joe Biden announced on August 24, 2022, a student loan relief plan that will cancel up to $20,000 in student debt for eligible borrowers, marking a historic moment in student loan forgiveness.

When giving remarks on the plan at The White House, Biden said “All of this means people can finally start to climb out from under that mountain of debt…To finally think about buying a home or starting a family or starting a business…when this happens, the whole economy is better off.” In formulating the plan, concerns over the global economic status of the US were also considered. Reuters reported that “American university tuition fees are substantially higher than in most other rich countries…Biden said other countries could bypass the United States economically if students are not offered economic relief.” With high university tuition fees placing a burden of student debt onto Americans, limiting the amount of money people can spend as consumers, demands decrease, which restricts potential economic growth.

Here are the basic facts of President Biden’s student loan forgiveness plan:

What does the plan do?

- The US Department of Education will provide up to $20,000 in debt cancellation towards Pell Grant recipients that have loans held by the Department of Education

- The Department of Education will provide up to $10,000 in debt cancellation towards non-Pell Grant recipients

Who is eligible?

- Borrowers with an individual income of less than $125,000, or $250,000 for married couples. (High-income individuals and households in the top 5% of incomes will not be benefitted by the plan)

The plan provides an opportunity for students to have less financial burdens while they advance their education. Richard Zuercher, an economics teacher at Timberline High School, shared his thoughts on the impact student debt has had on peoples’ lives: “Student debt continues to be a heavy burden for everyone…it’s just one more thing to worry about and eventually the payments will have to be made once again,” he said. “…these payments decrease the amount [people] can spend on other things like housing, food, clothing, medicine, and other things.”

Zuercher, who was once a college student like millions of Americans today, had to take student loans and pay them back. “When I graduated, I applied to the Public Loan Forgiveness Program… I worked as a teacher and made my payments for 10 years and my loans were forgiven. This has been an excellent boost to [my] family’s income and an amazing sigh of relief that I am no longer in debt.”

Though Biden’s plan showcases a more direct federal approach towards student debt in the US, it has met contrasting views. On September 12, more than 20 governors signed a letter to President Biden, asking for a withdrawal of his student loan plan, arguing that the burden of student debt would be redistributed and paid by taxpayers. The letter also stated that those willing to attend college and take on debt was a choice, and “Americans who did not choose to take out student loans themselves should certainly not be forced to pay for the student loans of others.” The letter ended with the governors challenging Biden’s power to go through with the plan, stating “As president, you lack the authority to wield unilateral action to usher in a sweeping student loan cancellation plan, a position shared by leaders of your party…we call on you to withdraw your student loan plan immediately.”

Despite the differing opinions and controversy, the plan will pause federal student loan repayment through December 31, 2022 to relieve financial burdens off students and potentially offset inflationary effects. Though student debt remains a large issue in the US, this plan will give Americans some financial relief off their backs.