Degree vs Debt: Is College Worth the Rising Cost?

Photo by: David Adam Kess

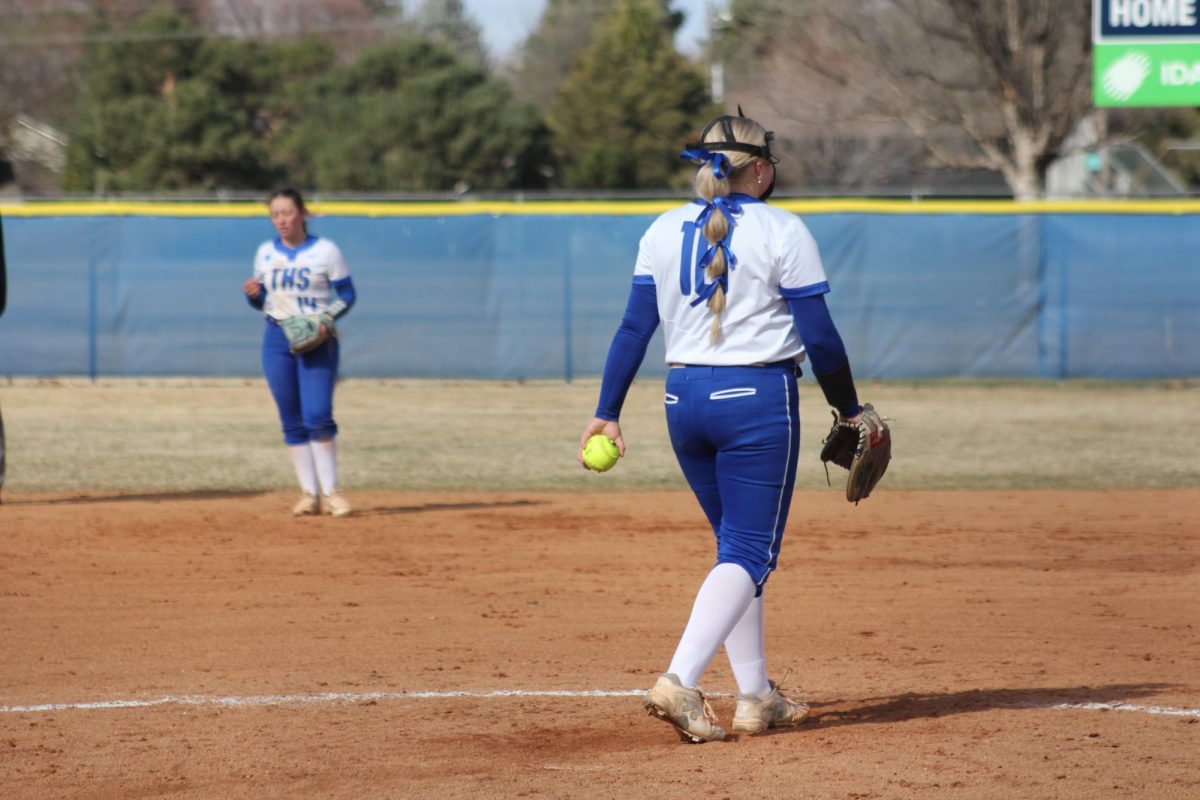

One of America’s most prestigious, well known, and expensive colleges Harvard costs $78,000 per year.

May 3, 2023

The idea of college is often associated with ivy covered halls, decorated dorms, professors with sweater vests, and creative classes. However, college is also increasingly aligned with rising costs: costs that are leaving students shackled in hundreds of thousands of dollars in debt when they graduate.

According to Forbes, the cost of public universities has more than doubled since 2000. Since the 1980s, the price of private schools has risen by 129% and the price of public schools has risen by 213%. Some attribute these costs to rising wages and inflation. But a study by CNBC found that the ever growing price of college continues to outpace family incomes, as wages have only increased by 67% since the 1980s.

But the culprit of these costs cannot be traced back to a single economic event or congressional bill; instead, the history of college costs is long and twisted, showing the true price of prestige, and just how far families are willing to go to pay for it.

The Pricey Past

Up until the mid to late 1950s, a college education was rare among the majority of Americans. According to NPR, college was inordinately expensive for most families and those who did attend college were usually young, wealthy white males who subsequently went into white collar middle class jobs.

Ad for veterans encouraging college education made possible by the GI Bill

But the accessibility of college dramatically changed when Congress passed the GI Bill in 1944, which helped sponsor the college education of returning WWII veterans and servicemen and is still in effect today. The GI Bill marked the beginning of America’s lengthy journey to making higher education more accessible, as a college degree became a one way ticket from poverty into the middle class.

Not long after the GI Bill, in the heat of the Cold War, the US passed the National Defense Education Act (1958), which sought to increase the prevalence of STEM jobs in order to compete with the Soviet Union. The National Defense Education Act established America’s first student loan program. It was built upon by the Higher Education Act, the Basic Educational Opportunity Grant program, and eventually the corporation Sallie Mae, which currently oversees most private student loans. According to NPR, once Sallie Mae was widely established in 1973, in partnership with both the federal government as well as for-profit college institutions, the process for students to take out loans became simplified. As the demand for college-level high paying jobs went up, enrollment numbers at colleges across the country dramatically increased, and students who once were unable to ever dream of a college education were now taking out student loans to afford one. Seeing this demand, as well as the ease in which students could slip into debt, colleges began to sponsor recruitment programs and raise their tuition.

However, as colleges raised their costs, the United States entered a fiscally conservative political era. State and federal government funding for colleges began to drop, and colleges began to rely on students for profit as these institutions struggled to pay for faculty costs and refurbished facilities. According to The Atlantic, decreases in federal funding created a schism that continues to deepen between American and European colleges in other developed countries, as these international schools often rely primarily on government funding instead of student payments. Thus, an American education began to cost more than an international one, and as college costs rose, students began to default on loans they were unable to pay back. This came to a head during the 2008 recession, when millions of Americans lost their jobs, jobs that college degrees had helped them procure. A pattern was sparked in 2008, and withstands today, as students took out loans to go to college in the hopes of raising themselves out of poverty, but the debt they accrued often took decades to pay off.

The Prestigious Present

Today, as cited by BestColleges.org there is over $1.5 trillion dollars in student loan debt among American college students. But despite a growing number of defaults, college prices continue to go up. In an effort to compete with hundreds of other institutions, colleges continue to invest in numerous administration positions as well as seemingly never-ending campus features. According to The Atlantic, American college students pay three times as much for living services like housing and dining compared to their European counterparts. Part of this difference can be ascribed to a disparate college culture between the US and Europe. In Europe, college is primarily an academic experience, and most students live at home while taking classes and tend to spend less time on campus. On the other hand, college in the US has become a lifestyle, with dorm housing and late night football becoming treasured parts of the youthful experience.

As colleges increasingly compete for students, they seek to offer a menagerie of different activities, facilities, and classes in an attempt to lure students and their pocketbooks to the classroom door.

To account for rises in student enrollment, colleges have also begun to increasingly invest in administrative positions, such as counselors and advisors. The number of counselors has risen by 60% since the early 2000s alone, as reported by Bloomberg. These positions add yet another extra cost to the college’s bill, and the US currently does not have any caps on college tuition to reign in the amount colleges spend.

The lack of any kind of restriction, aside from student enrollment, has led to an over inflation of college prices. As colleges seek to attract more and more students, some have raised their prices to create a perception of higher quality, as oftentimes more prestigious universities are associated with higher costs, with colleges like Harvard and Columbia costing well over $60,000 per year in tuition alone.

But these higher prices haven’t necessarily led to better educational outcomes.

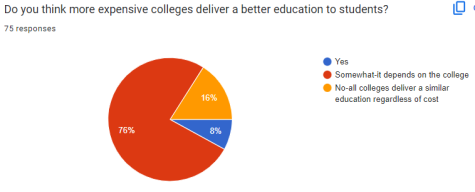

Graph showing a sample of senior’s opinions on college costs

“I think the issue is that there is an inflation with reference to college degrees, as they become costlier and costlier, they continue to devalue,” says one Timberline student.

A 2014 Gallup-Purdue study found that for students, the prestige of the school matters less than the experiences they have. Engaging internships, professors, and extracurriculars were seen to increase workplace engagement and satisfaction more than the selectivity or the cost of a college.

In regards to what contributes to their college decision one Timberline student says, “I actually think about culture and worth to me- not cost or fame.”

For many, the payoff of prestigious schools comes with the multi-industry professional connections they offer.

One Timberline student sees these connections as the most important aspect of college saying, “College is for connections.”

According to The Hill, although these connections can be helpful in entering the job market right after college, graduates’ 2008 earnings from open admission schools were only $5,000 less on average than graduates from highly selective schools. So is the value of these prestigious schools really worth the extra cost?

Cost figures are not absolute, as they fluctuate depending upon the job a student wants to pursue. For careers that rely on connections, a more well known school might be worth the price for some students, but for many a college education (from any school) will be enough to set their future earnings ahead of their peers who do not complete a post secondary education. According to the Pew Research Center, those who do not pursue a secondary education are more likely to be unemployed than those who do.

Ultimately the question of whether or not college is worth it, is highly subjective.

This concern about lasting debt seems to be a common thread amongst students.

Many students also stress the importance of pursuing a direct path in college. As one student says, “I think it really depends on what you are choosing to pursue…I don’t think people can really afford to just go to college if they don’t know what direction they’re going.” This student seems to express the necessity of questioning the purpose of a college education, and how that education will serve one in their future career.

Extra curriculars, lifestyle, educational opportunities, and cost are also factors that go into a student’s momentous college decision. But it is ultimately up to each individual to decide, what they will prioritize most and what will be the cost of their final decision.

Systematic Solutions

Affordability as the root cause of college decisions has become a point of frustration for both students and families. Many believe that the cost should not determine where one attends school, and instead students should be able to pick a school based upon academics, community, and personal interests.

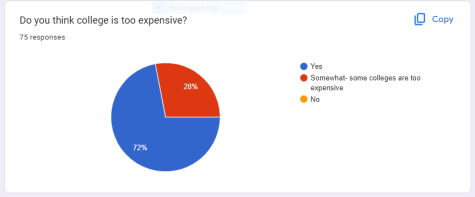

Graph showing a sample of senior’s opinions on college costs

According to students surveyed by the Timberline Paw Print, college on the whole is too expensive.

One student put it bluntly saying, “College is ridiculously priced.”

Frustrations like these have led to widespread calls for systematic change to the college system. In an attempt to address these calls, last year President Biden announced a student loan forgiveness plan that would cancel $400 billion in student loans. But, according to CNBC, the plan has faced considerable opposition at the federal level and is currently under review by the Supreme Court.

Although the plan offers temporary relief, more systematic change may be required to permanently shift the high costs of college. For long term change, according to Forbes, Manhattan Institute economist: Beth Akers, encourages transparency in the costs that colleges publish. “Price transparency and robust competition have gone a long way towards reducing prices in other industries. The higher education system should follow their lead,” says Akers.

The Atlantic suggests that college prices should be regulated through government mechanisms such as price caps.

But in a deeply partisan Congress, any solution will take cooperation and time to pass. In the meanwhile, students and families are left on their own to try and find affordable solutions.

Students can apply for scholarships offered by both their college and private organizations, like Coca Cola or Walmart. Scholarship sites like GoingMerry and Bold.org can help students match with scholarships that fit their demographics, interests, and major. But, as cited by ThinkImpact, only 13% of students receive private scholarships, and oftentimes private scholarships are unable to cover the full cost of college

Money coming from a graduation cap

There are other options: an in-state education can cost up to three times less than an out of state education, and online degree programs cost approximately $10,000 less than in person degree programs. For many students, in person experiences like college events, Greek life, and classroom discussions are an essential part of the college experience, but an online degree can be an affordable option for those who may want to live remotely, or wish to pursue an education while working full or part time.

In terms of affordability, a Timberline student says, “I think you should do whatever you can to make college affordable. Don’t go to an expensive college. It may be cool at the moment but taking on all that debt is not worth it.”

Scholarships, in state schools, and online schools are just a few of the many pathways students can take to try and make college more affordable. But, as history has proven, long term and substantial change will usually only come at the national level. Until then students must decide for themselves whether college is worth the cost, and only time will tell if the price pays off.